All Americans drive used cars, because once a "new" car is driven off a dealer's lot it ceases to be new. A lot is being written about the impact of tariffs on new car prices. What happens in the used car market is, I believe, much more important.

Prices will rise, people will keep cars longer, but because of tariffs on China and elsewhere, it will increase repair costs. Instead of people with old cars being able to trade their clunkers for cash, they will be burning cash to try to keep their clunkers on the road.

I will insert links at the end, and periodically add to the list.

A Simple-minded Analysis

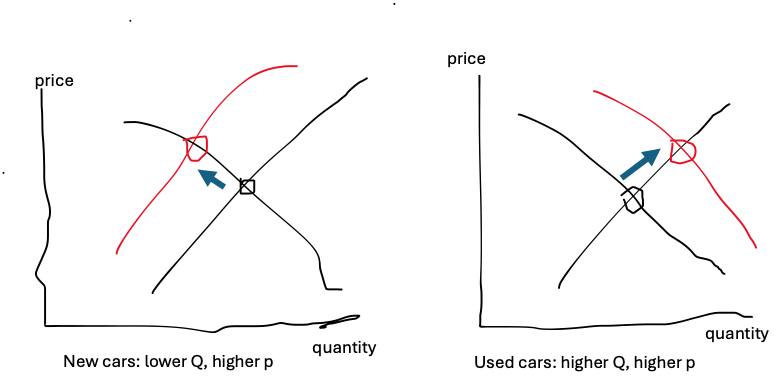

Tariffs are already impacting the market for new vehicles. Some firms have already stopped shipping specific vehicles to the US, and with 25% tariffs others will be forced to follow suit. Obviously, if a few million units are pulled out of the 16.6 million unite US market, supply falls – in the graph below, it shifts to the left – and prices rise while quantity falls.

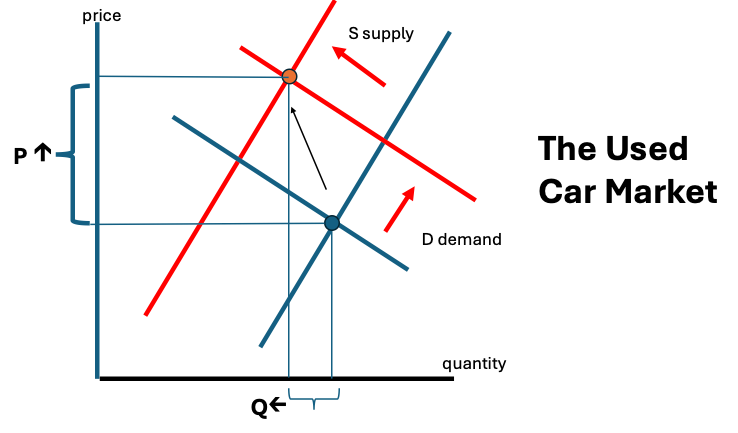

Continuing the Econ 101 analysis, since new and used cars are substitutes, that will shift the demand curve for used cars to the right, resulting in more purchases of used cars at higher prices.

Used vehicle supply

Unfortunately, the above analysis ignores where the supply of used vehicles comes from.

The biggest source of used vehicles are consumers buying a "new" used vehicle and selling their "old" vehicle to someone else. That results in no net change in supply, though in the normal course of events those that are the oldest and in the poorest condition get turned into scrap.1 So the overall market depends on the stream of cars being sold by their first owner into the used vehicle market. There are 3 major streams, detailed below.

Trade-ins

Trade-ins tied to the purchase of a new car are one important flow.2 But with new car sales set to decline, there won't be as many trade-ins – the US imported about 7.7 million vehicles in 2024, and due to the new tariff their wholesale price will rise 25%.3 Because people will be buying fewer cars and light trucks, used car supply will shift to the left.

Lease returns

Lease returns are a variation of trade-ins for a new car. Many consumers "purchase" vehicles under 3-year leases, ditto many businesses. Unfortunately, 3 years ago the auto industry still hadn't recovered from COVID supply chain shocks. That means the "flow" of lease returns remains depressed, one reason that used car prices are 20% higher than for the 25 years prior to covid – yes, a quarter century – even if they are down 13% from their early 2022 peak.

Now what happens in the 3rd year? At the end of the lease there's a residual value, locked in up front when the “purchaser” starts the lease. If used car prices are strong, then "owners" will opt to pay the residual value to the leasing company, and keep the car. High new-car prices push people in the same direction, it's better at the 3 year point to buy lease rather that swapping it for a newer one that carries a far higher price tag. Coming and going, higher new and used car prices result in fewer lease returns, again shifting supply to the left.

Rental car fleets

Another big inflow of used cars is from rental car companies, which pre-pandemic bought 1.7 million new vehicles a year, and "defleeted" a similar number as used vehicles. Given new car price hikes, fleets will purchase fewer new cars, and to offset that will keep the cars in their fleets longer. In any case, fewer rental cars will enter the used car market, again shifting supply to the left.4

The bottom line

My simple analysis is wrong, because the supply curve of used cars will also shift to the left.5 On net, the quantity will fall, not rise, and prices will be corresponding higher.

Note that the supply is diminished at the "good" end of the market, as rental car companies keep their cars for at most 2 years, 3-year lease returns are (duh!) 3 years old, and new cars are purchased by the upper income end of the population, so that trade-ins are generally "younger" than the average vehicle in operation, which is now over 12 years old. That will mean that it will be particularly hard to find a "good" used car.

Clunkers for Cash

Americans will therefor hold onto their vehicles longer, and thus on average shift their budgets to greater expenditures on maintenance and lower expenditures on car payments. Unfortunately, a large proportion of repair parts are imported. Keeping that clunker will burn up cash.

During the Great Recession we had a "Cash for Clunkers" program.6 Similarly, since summer 2024 China has had a "new-for-old" (以旧换新) policy to prop up sales of cars and household appliances, in an attempt to offset the effects of falling real estate prices on consumption.

Tariffs are a "clunkers burning cash" program.

Links:

Apr 10, WSJ: Auto Tariffs Are Still On—and Would Raise the Cost of Just Owning a Car; Higher repair and insurance bills await people sticking with current ride

more about trends, so a complement to my article here

Apr 10, Automotive News via Reuters: CarMax says Q4 net income surged 79% but stock slips on missed expectations

note I expect higher used car prices will give them and Carvana a boost, because their inventory will appreciate rather than depreciate. I have not looked into whether I should buy shares in them, there may be a “buy the dip” possibility.

On an ongoing basis, check the used car stories on Automotive News

Apr 15, AutoBlog: Used Car Sales, Prices on the Rise Amid Tariff Concerns – As tariffs raise uncertainty in the auto market, more buyers are turning to used vehicles, driving up prices and tightening supply, especially for budget-friendly options.

Apr 16, CarScoops: Used Car Prices Are Exploding And Buyers Are Still Lining Up For Them – There's a worsening used car shortage and buyers will end up paying more

The same happens to vehicles that undergo sudden depreciation from hitting a deer or another vehicle, except that for recent-vintage vehicles the engine and rear body panes may be undamaged and "salvaged" for use as repair parts.

In fact I will trade my old car for a new pickup truck next week. It's a 10-year-old sedan with 110,000 miles on it, and the even bigger negative of a manual transmission – most Americans no longer know how to drive a stick-shift. It still runs fine, so while the dealer may not recondition it to put on their lot, it likely won't be relegated to the scrapyard.

We previously had a 25% tariff on light trucks imported from outside the USMCA (Mexico and Canada). As a result, we import no pickup trucks from Europe, Japan or Korea, and very few SUVs that get classed as trucks. That tariff stemmed from a 1963 trade spat with Europe over their restrictions on imports of frozen chicken from the US. To comply with trade law, that tariff applied to truck imports from any country. However, it was in fact targeted at Germany, as at the time the US only imported a single light truck model, the VW van. That era, after all, was long before the rise of Japanese as global players in the auto industry. That temporary tariff, however, is still in effect over 70 years later. Combined with the "neutral" rules on fuel efficiency and the higher profits from selling larger vehicles, sedans have gradually disappeared from the US market, dropping from over 70% in 1963 to under 30% today.

Everything else may not be equal, because a recession will lower rental car demand. So Enterprise (the biggest) and its competitors will buy fewer new vehicles, while not reducing their “defleeting”. Potentially they will sell off more cars for a few months, as happened when business and leisure travel collapsed during the early months of the COVID pandemic in 2020. Thereafter they will transition to a new, lower level to reflect the smaller fleet needed to service an economy in recession.

I ignore dynamics. Briefly, trade-ins will fall as sales fall, whether for a sale or for a lease. Rental fleets will likely react faster. If they defleet quickly, that will slow the rise of used car prices for a few months. after which defleeting will fall to a lower level to reflect smaller fleet size, and no longer act as a restraint on prices.

Slower new car sales will depress the flow, potentially for a few years. However, the impact from fewer new leases won’t start affecting the inflow of used vehicles until 2028. There can still be an immediate but smaller [“second order”] effect if more current lessors keep their vehicles rather than turning them in.

The 2009 "Cash for Clunkers" program was officially known as the Car Allowance Rebate System.